5 min read

4 Lead Generation Strategies and Best Practices for Quality Leads

TL;DR: Getting more leads isn’t enough—you need quality leads. These 4 smart lead generation strategies help attract...

Fraudulent leads undermine the effectiveness of marketing campaigns, resulting in a failure to achieve desired results and a lack of return on investment. These leads contribute to inflated metrics and misleading performance data, ultimately wasting valuable resources and exacerbating the negative impact on the marketing budget.

Wasting call center resources on attempting to contact bad leads, including wrong numbers, disconnected numbers, stale leads, bad information, and confused customers, can result in significant time and monetary losses while yielding minimal or no productive outcomes.

Contacting individuals who never provided their information can have a swift and detrimental impact on your brand reputation. This practice can quickly tarnish your brand's image and credibility among customers and potential clients.

Using fake leads can lead to TCPA violations and substantial fines, as these leads may contain personal information of individuals who never gave consent to be contacted. Businesses can face penalties ranging from $500 to $1,500 per incident, regardless of whether they were aware of the violation prior to making the call.

Persistent negative outcomes from contacting unproductive leads can significantly impact company morale. Sales staff experience heightened frustration, demoralization, and increased stress due to not meeting quotas, dealing with angry leads, fear of contacting new leads, and a negative attitude towards leads with perceived low conversion value. These factors collectively contribute to a decline in employee confidence and overall team morale.

Chasing after bad leads wastes your sales team’s time, letting genuine leads from your campaigns grow cold. This could lead to potential customers choosing a competitor’s product before your team has time to reach out, thus costing you sales.

Fraudulent leads undermine the effectiveness of marketing campaigns, resulting in a failure to achieve desired results and a lack of return on investment. These leads contribute to inflated metrics and misleading performance data, ultimately wasting valuable resources and exacerbating the negative impact on the marketing budget.

Wasting call center resources on attempting to contact bad leads, including wrong numbers, disconnected numbers, stale leads, bad information, and confused customers, can result in significant time and monetary losses while yielding minimal or no productive outcomes.

Contacting individuals who never provided their information can have a swift and detrimental impact on your brand reputation. This practice can quickly tarnish your brand's image and credibility among customers and potential clients.

Using fake leads can lead to TCPA violations and substantial fines, as these leads may contain personal information of individuals who never gave consent to be contacted. Businesses can face penalties ranging from $500 to $1,500 per incident, regardless of whether they were aware of the violation prior to making the call.

Persistent negative outcomes from contacting unproductive leads can significantly impact company morale. Sales staff experience heightened frustration, demoralization, and increased stress due to not meeting quotas, dealing with angry leads, fear of contacting new leads, and a negative attitude towards leads with perceived low conversion value. These factors collectively contribute to a decline in employee confidence and overall team morale.

Chasing after bad leads wastes your sales team’s time, letting genuine leads from your campaigns grow cold. This could lead to potential customers choosing a competitor’s product before your team has time to reach out, thus costing you sales.

Genuine leads typically display interest and readily engage with businesses they have shown interest in. If customers claim they never filled out a form or exhibit a lack of familiarity with your brand, it could be an indication of lead generation fraud.

If you notice unusually low conversion rates despite a high volume of leads, it might be a sign of fraudulent practices. Legitimate leads typically show a good degree of interest and have a higher chance of converting.

Fraudulent leads have irrelevant or inconsistent information. If leads fail to meet your qualification criteria or show a pattern of inaccurate data (wrong number, bad email) or incomplete data, you might be dealing with fraud.

Sudden influx of leads not aligned with marketing activities could be a red flag for fraudulent activity.

Repeated complaints from the sales team about lead quality may indicate lead generation fraud.

Suspiciously high concentrations of leads from the same region or industry could indicate potential fraud.

Anura’s fraud solution weeds out the fraudulent leads, ensuring that your marketing dollars aren't wasted. This reduces inflated metrics and misleading performance data, thus optimizing your marketing budget.

With Anura, you can allocate your call center resources effectively. Our solution identifies and removes bad leads from your funnel, enabling your call center staff to focus on potential customers who are genuinely interested in your product or service.

By eliminating fraudulent leads, Anura helps you contact only those individuals who have provided their genuine information. This practice preserves your brand image and enhances your credibility among your customers and potential clients.

Anura’s system ensures that the leads you contact are real. This lowers the risk of violations and subsequent fines, thereby protecting your business from unnecessary legal complications.

With Anura, your sales staff can focus on productive leads, thus reducing their frustration and stress levels. This contributes to a healthy work environment, boosting employee confidence and team morale.

Anura ensures you never miss a genuine opportunity again. By filtering out bad leads, our solution gives your sales team more time to engage with legitimate prospects, turning leads into valuable customers.

Anura’s fraud solution weeds out the fraudulent leads, ensuring that your marketing dollars aren't wasted. This reduces inflated metrics and misleading performance data, thus optimizing your marketing budget.

With Anura, you can allocate your call center resources effectively. Our solution identifies and removes bad leads from your funnel, enabling your call center staff to focus on potential customers who are genuinely interested in your product or service.

By eliminating fraudulent leads, Anura helps you contact only those individuals who have provided their genuine information. This practice preserves your brand image and enhances your credibility among your customers and potential clients.

Anura’s system ensures that the leads you contact are real. This lowers the risk of violations and subsequent fines, thereby protecting your business from unnecessary legal complications.

With Anura, your sales staff can focus on productive leads, thus reducing their frustration and stress levels. This contributes to a healthy work environment, boosting employee confidence and team morale.

Anura ensures you never miss a genuine opportunity again. By filtering out bad leads, our solution gives your sales team more time to engage with legitimate prospects, turning leads into valuable customers.

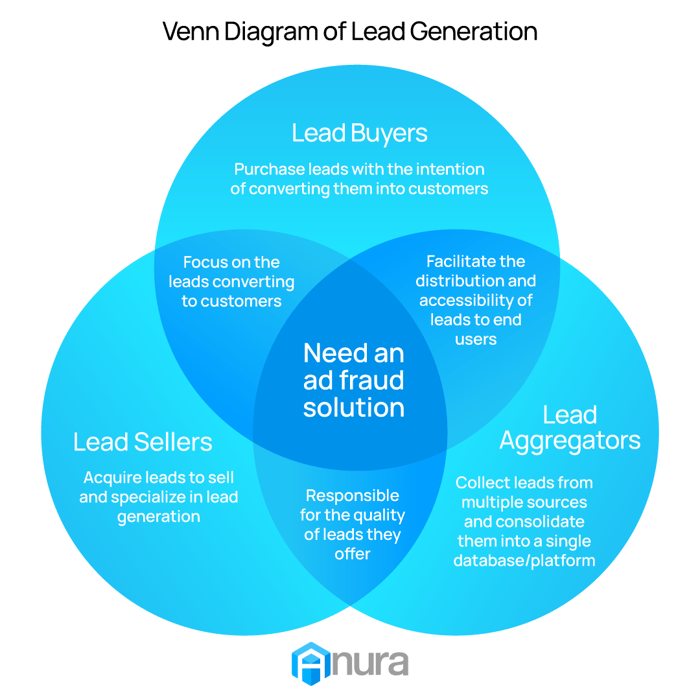

"Picture Anura and other ad fraud solutions like a Venn Diagram. There is a section that overlaps that both Anura and other solutions catch, but then there is the other area. We find that the Anura system catches a lot of stuff the others didn't, and overall, paints a better picture of what is actually happening."

- Apollo's Compliance Team

Lead generation fraud can also have a significant impact on lead sellers. Fraudsters can damage the reputation of lead sellers by creating fraud leads and passing them off as legitimate. This can make it difficult for legitimate lead sellers to find customers.

One of the core battles for lead sellers is upholding the quality of their leads. Businesses buying leads expect them to be of high quality, meaning they should represent potential customers who are genuinely interested in the products or services being offered.

For a lead to be legally and ethically viable, clear and concise consent is paramount. Fraudulent leads, by their very definition, lack this consent, thus posing a significant compliance issue. A serious dilemma that every lead seller must vigilantly navigate.

Lead sellers also face the complex web of data privacy regulations, which vary greatly across countries. Violating these regulations, often inadvertently due to fraudulent leads, can result in substantial penalties.

Fraudsters can create fake leads that are not qualified or interested in the products or services being offered. This can waste a company's time and resources, and it can also damage their reputation.

Fraudsters can use owned and operated sites to generate leads that are not compliant with the Telephone Consumer Protection Act (TCPA). This can result in fines and penalties for the company.

Fraudsters can use owned and operated sites to collect personal information from leads. This information can then be used for identity theft or other crimes.

If a company is associated with lead generation fraud, it can damage their brand reputation. This can make it difficult to attract new customers and partners.

Fraudulent leads can significantly impair your sales process, consuming valuable time and resources of your sales team. With your team preoccupied chasing counterfeit leads, the attention towards pursuing qualified leads diminishes, thus impacting overall sales efficiency. For maintaining optimal sales performance, it's crucial to identify and weed out these detrimental fake leads.

In a world brimming with myriad data privacy regulations like GDPR and CCPA, ensuring compliance becomes critical. The responsibility lies with you to ascertain leads come from reliable, ethical sources, thereby protecting your company's reputation, and avoiding legal complications.

Fraudulent leads result in wasted resources as the buyer invests time, effort, and money into pursuing leads that have no potential for conversion. This includes expenses related to marketing campaigns, lead nurturing activities, and sales efforts.

The return on investment (ROI) of lead generation campaigns can be negatively impacted by fraud. If a significant portion of the purchased leads turn out to be fraudulent, the overall conversion rate decreases, reducing the ROI and profitability of the campaign.

Fraudulent leads often require additional vetting and verification processes to identify genuine prospects. This adds to the cost of lead acquisition, as companies may need to invest in advanced fraud detection tools, employ dedicated staff, or outsource verification services.

Buying fraudulent leads can harm a company's reputation. If the leads are found to be fake or of poor quality, it can damage trust and credibility with customers and partners. Negative reviews or word-of-mouth can discourage potential customers from engaging with the company, leading to further financial losses.

Lead buyers are the last line of defense against fraud. Contact us today to secure your position as a responsible lead buyer.

Ping post is a lead distribution technology that allows lead sellers to send a partial lead (usually non-sensitive information) to multiple lead buyers in real-time. The buyers can then evaluate the lead and decide if they want to purchase it based on their criteria. If interested, the buyer submits a bid, and the lead seller can then choose the highest bidder or other factors to sell the lead. This process ensures that lead sellers can maximize their revenue while buyers get leads that fit their criteria.

As lead aggregators strive to connect businesses with high-quality leads, they rely on trustworthy sources and genuine data to ensure the success of their clients' campaigns. Unfortunately, lead generation fraud poses a significant threat to their operations and reputation. Let's explore the consequences that lead aggregators face when confronted with lead generation fraud:

Lead aggregators invest substantial time, effort, and resources in acquiring leads. However, when fraudulent leads infiltrate their system, valuable resources are wasted on unproductive and fake leads. This drains the profitability of their campaigns and diminishes their ability to deliver genuine results.

Trust is the foundation of any successful lead aggregation business. Lead generation fraud tarnishes the reputation of lead aggregators as clients receive poor-quality leads or realize that they have fallen victim to fraudulent practices. The negative impact on reputation can lead to client loss, decreased referrals, and long-term damage to the brand image.

Ensuring the quality of leads is crucial for lead aggregators. If leads are aged Are aged leads fraudulent?Aged leads are not fraudulent, but they may not be as valuable as fresh leads. Aged leads are contacts that have been generated or acquired by a business but have not been contacted or engaged with for a period, usually several months or longer. Plus, when you buy aged leads, you may not have consent to contact them, which can lead to TCPA issues. recycled, inaccurate, or irrelevant, it devalues the entire service. Quality assurance methods and data verification techniques must be constantly improved and updated to maintain reliable leads.

With the increasing emphasis on data privacy and legal regulations non-compliance can result in severe penalties, posing a challenge for lead aggregators who must stay abreast of these evolving rules. Lead Aggregators must provide proof of consent before resale.

Lead aggregators invest substantial time, effort, and resources in acquiring leads. However, when fraudulent leads infiltrate their system, valuable resources are wasted on unproductive and fake leads. This drains the profitability of their campaigns and diminishes their ability to deliver genuine results.

Trust is the foundation of any successful lead aggregation business. Lead generation fraud tarnishes the reputation of lead aggregators as clients receive poor-quality leads or realize that they have fallen victim to fraudulent practices. The negative impact on reputation can lead to client loss, decreased referrals, and long-term damage to the brand image.

Ensuring the quality of leads is crucial for lead aggregators. If leads are aged Are aged leads fraudulent?Aged leads are not fraudulent, but they may not be as valuable as fresh leads. Aged leads are contacts that have been generated or acquired by a business but have not been contacted or engaged with for a period, usually several months or longer. Plus, when you buy aged leads, you may not have consent to contact them, which can lead to TCPA issues. recycled, inaccurate, or irrelevant, it devalues the entire service. Quality assurance methods and data verification techniques must be constantly improved and updated to maintain reliable leads.

With the increasing emphasis on data privacy and legal regulations non-compliance can result in severe penalties, posing a challenge for lead aggregators who must stay abreast of these evolving rules. Lead Aggregators must provide proof of consent before resale.

The lead generation industry is faced with a serious issue - the prevalence of counterfeit leads. These deceptive practices involve fraudsters exploiting genuine personal details to fabricate leads or registrations.

Even though the information may seem valid, the origin of it is not. Marketers operating on a performance basis might be under the impression they've procured a new promising lead. However, if this data wasn't provided directly by the user, reaching out to this lead may result in a breach of TCPA regulations.

Lead generation fraud refers to the creation and sale of fictitious or unqualified leads under the guise of legitimate leads typically using bots, malware, or human fraud farms. It involves deceptive practices that negatively affect both businesses and consumers.

There are many ways that your advertising could be affected by those seeking to commit fraud. So what are some of the most common types of fraudulent activity to keep an eye out for?

When it comes to lead generation fraud, fraudsters can use stolen personal data to fill out forms. Another tactic is to purchase aged leads and recycle them as new leads.

Bot traffic is another way fraudsters attack the lead generation process of companies. These small pieces of computer software crawl the internet to find forms on landing pages that can be filled out to create fraudulent leads. These programs then use stolen information, aged lead data, or completely fake data that looks real to fill out the form and submit it as a real visitor would.

Finding the right ad fraud solution for your lead generation campaign starts with a focus on data. Anura provides a solution that empowers marketers with a user-friendly experience that works. By analyzing the visitor data of your traffic and lead sources, you'll be able to identify fraud in real time so you can deal with it in real-time. You’ll know if the lead is fraudulent before the visitor even finishes filling the form out.

We offer a detailed analytics dashboard with the ability to drill down and pinpoint exactly where fraud originates. Contact us to get started today.

Businesses that are heavily dependent on online marketing campaigns and advertising strategies are the most susceptible to lead generation fraud. This typically includes industries like finance, insurance, real estate, and education, which rely heavily on lead generation for customer acquisition.

There are numerous negative consequences of lead generation fraud. Brand reputation damage is a serious consequence, but there are rippling financial effects as well. From the lead generation company to the businesses buying leads to the sales team that's calling the leads, many layers of people are negatively impacted by lead fraud. Here are the four main ways this type of ad fraud hurts companies.

If a lot of people are being called who never asked to be contacted by your company, your brand reputation suffers. These people will ask themselves where and how you’re getting their contact information, damaging the image of your company.

Fraudulent lead information can also cause your contact rates to take a dive. When people aren’t expecting a call about your services, they either don’t answer or take a long time to respond. Once your salespeople finally hear back, it’s a no. This wastes precious call center resources that could be spent on leads that convert.

Lower conversion rates are another consequence of lead generation fraud. If you've noticed a sudden decline in your conversion rates, you might want to look into whether or not fraud is the root cause. Lead generation fraud increases your cost per lead and ultimately your cost per acquisition because your percentage of leads that don’t convert goes up. This wastes your marketing resources.

Another major consequence of lead generation fraud is being hit with TCPA violations and potential fines. People take the Do Not Call list very seriously, creating a high potential for your company getting in trouble when the leads you call never provided their information. This is a leading reason why blocking leads filled with stolen personal information is so important.

Fraudulent leads can be identified through several means such as inconsistencies in the information provided, data that matches known fraudulent data points, or behaviors that indicate non-human interactions (like rapid-fire form completions). Also, if the person on the lead claims they didn’t fill out the form or they are hard to reach, is another way to identify possible fraudulent leads.

Our software integrates as easy as deploying a JavaScript tag on your site. This can be done in minutes using Google Tag Manager without the need for development resources. While our software is very flexible, more intricate integrations would require some minor development resources.

Lead fraud is a significant problem. On average, 1 in every 4 leads is fraudulent. It not only wastes marketing resources, it also wastes call center resources, generates brand reputation issues and creates TCPA violations.

Lead generation fraud occurs when bad actors use bots or human fraud farms to visit a landing page uses invalid, fake, stolen or aged information to fill out a form with the intent of making money directly or indirectly.

Common signs of lead generation fraud is when the person is either unreachable, or denies completing a form. Additionally, inconsistencies in the provided information, instances of stolen or outdated lead data, as well as entirely fabricated data are other frequent signs of potential fraud.

Lead generation fraud can impact businesses in several ways: it wastes marketing resources, tarnishes brand reputation, wastes call center resources, creates TCPA violations, and destroys employee morale.

Participating in lead generation fraud has significant consequences for individuals and businesses. It can result in lower ROI for marketing campaigns, increased TCPA risks, wasted staff resources, and damage to brand reputation. Generating fraudulent leads not only wastes valuable resources but also puts businesses at legal and regulatory risk. Moreover, it erodes customer trust, leading to a decline in customer acquisition and damaging industry relationships. Therefore, it is crucial to prioritize ethical lead generation methods and use the available technologies to reduce lead generation fraud to avoid these consequences and maintain a positive brand image.

The most proactive way to detect and prevent lead generation fraud is to use a Media Rating Council (MRC) or Trustworthy Accountability Group (TAG) Certified, performance-based ad fraud solution using a Sophisticated Invalid Traffic (SIVT) filter.

If you suspect lead generation fraud, there are a few steps you can take. First, consider signing up with a performance-based ad fraud solution, like Anura, that is certified by organizations like the Media Rating Council (MRC) or the Trustworthy Accountability Group (TAG). These certifications ensure that the solution adheres to industry standards and best practices. Next, run a test with one of these solutions to confirm your suspicion. If your suspicions are confirmed, it is crucial to deploy a fraud solution that can help eliminate these types of leads in the future. This will help protect your business from wasting resources on fake or low-quality leads and maintain the integrity of your lead generation efforts.

Technology plays a crucial role in identifying and preventing lead generation fraud by enabling proactive measures to detect and mitigate potential issues before they occur. Using advanced algorithms, machine learning, and artificial intelligence, technology, like Anura, can analyze various data points and patterns to identify suspicious behaviors and red flags that will indicate fraudulent activity. By implementing robust fraud detection systems, businesses can automatically screen and filter visitors before allowing them to fill in their forms. This proactive approach minimizes the risk of issues that may arise after a form is filled out and submitted, such as fraudulent information, invalid leads, or malicious intent, thereby safeguarding businesses and optimizing the efficiency of lead generation processes.

Finding the right ad fraud solution for your lead generation campaigns starts with a focus on data. Anura provides a solution that empowers marketers with a user-friendly experience that works. By analyzing the visitor data of your traffic and lead sources, you'll be able to identify fraud in real time so you can deal with it in real-time. You’ll know if the lead is fraudulent before the visitor starts filling the form out.

To educate your team or employees about lead generation fraud prevention, it is important to create awareness about the potential risks and provide them with effective strategies and tools. Start by emphasizing the significance of lead generation fraud and its impact on the business. Explain how fraudsters may generate leads through deceptive means, such as falsifying information or using advanced bots and human fraud farms. Teach your team to verify leads by implementing a process where they ask callers if they recently filled out a form and check the timing. If a lead was not generated on the same day, it indicates potential fraud or recycling aged leads. Introduce them to solutions like Anura, which can help detect and prevent fraudulent leads. Train your team on how to use such tools effectively, ensuring they understand the signs of fraudulent activities and how to report and handle them appropriately. By equipping your team with knowledge and tools, you can significantly reduce the occurrence of lead generation fraud.

One great resource you can use for training is our Lead Generation Fraud 101.

Several years ago, the Media Rating Council (MRC) set industry standards for fraud detection companies and continues to update those standards each quarter. Both MRC and Trustworthy Accountability Group (TAG) can certify that a given fraud solution is following those standards through third-party audits.

Absolutely! Anura has a wide range of case studies specifically focused on lead generation companies, showcasing our unrivaled accuracy, thoroughness, and advanced analytics. You can explore our comprehensive collection of case studies here to see how Anura has revolutionized lead generation strategies and generated exceptional results for our clients.

We offer a range of resources for raising awareness about lead generation fraud, including our weekly blog, eBooks, Whitepapers, and monthly webinars. Other organizations, such as the MRC and TAG, also provide valuable resources.

Fake leads refer to fraudulent or non-genuine prospects that mislead businesses into thinking they are valuable leads. These can include bots, bogus contact information, or individuals who have no intention of converting into customers. Fake leads waste marketing resources, distort performance metrics, and hinder effective lead generation efforts. Identifying and filtering out fake leads is essential for optimizing marketing strategies and ensuring high-quality, actionable leads.

Fraud leads are illegitimate contacts or prospects generated with the intent to deceive businesses into thinking they are real potential customers. Often created by bots, fake users, or malicious sources, fraud leads skew performance metrics, waste marketing resources, and harm lead generation efforts by diverting focus from genuine, actionable leads.

Aug 13, 2025

TL;DR: Getting more leads isn’t enough—you need quality leads. These 4 smart lead generation strategies help attract...

Jan 2, 2025

TL;DR: This blog discusses the shift from traditional advertising to more cost-effective affiliate marketing...

Mar 27, 2024

Unless you’ve been living under a rock for the past year, you know that the Federal Communications Commission (FCC) is...

Mar 6, 2024

By now, you’ve heard about the December ruling from the Federal...

Jan 24, 2024

There’s more than an extra day to look forward to in 2024: new episodes of our favorite shows, a total solar eclipse,...

Jan 10, 2024

It’s no secret that the lead generation industry will face new challenges this year. Whether your business is...